salt tax impact new york

Just six statesCalifornia New York New Jersey Illinois Texas. Over the weekend New York became the first state to create a state and local tax SALT deduction cap workaroundtwo workarounds in fact since New York does nothing on a small scale.

What Is The Salt Cap And Why Do Some Lawmakers Want To Repeal It

The Rockefeller Institute of Government and the New York State Division of the Budget have examined the impact of the SALT cap.

. Cuomos initial budget proposal in January and it comes at a time when many Democrats are calling on Pres. When does this go into effect. For S corporations wishing to utilize the PTET ensure proper New York S election is on file.

New Yorks SALT Avoidance Scheme Could Actually Raise Your Taxes. The New York state budget deal announced yesterday includes a workaround of the temporary federal limit on state and local tax deductions the SALT cap. New York supports 107000 fewer additional.

The 10000 cap on state and local tax deductions for now may be here to stay however. The acronym SALT stands for state and local tax and generally is associated with the federal income tax deduction for state and local taxes available to. The provision was part of Gov.

Determine possible cash flow and distribution implications. The SALT cap was tucked into the 2017 tax overhaul in part to help finance it and reduce its impact on the deficit. Key findings are as follows.

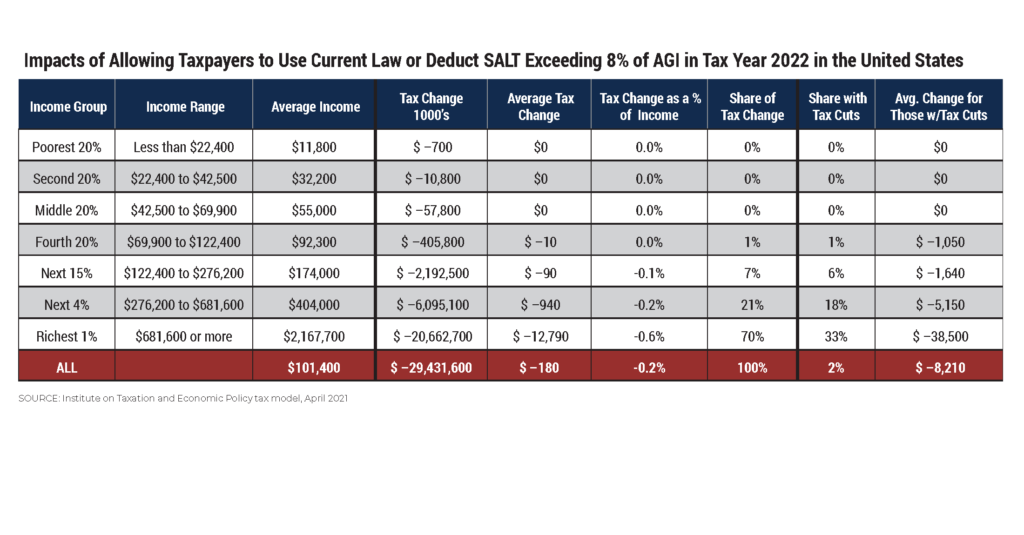

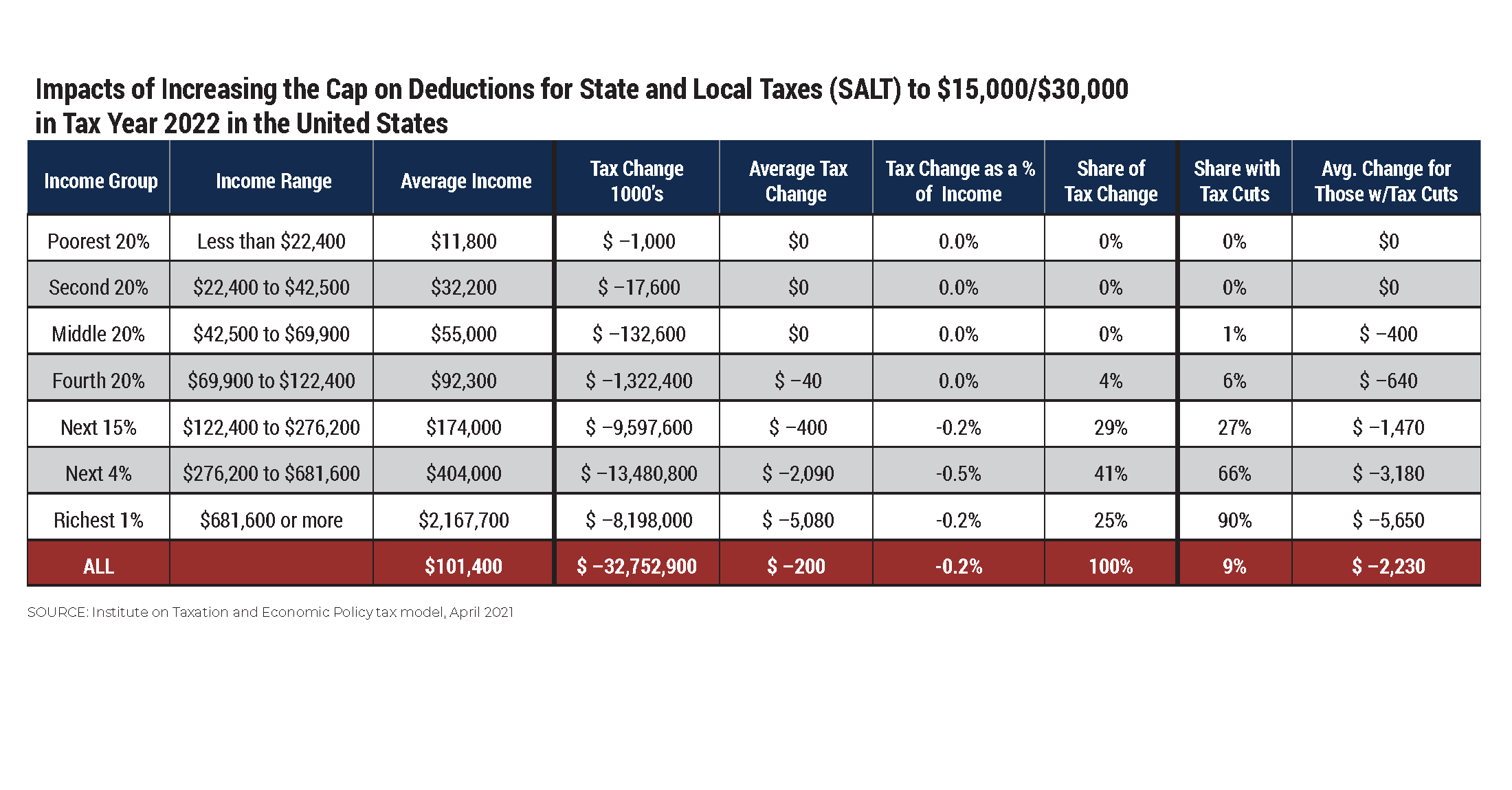

New York has issued long-awaited guidance and clarifications on the Pass-Through Entity Tax PTET via a Taxpayer Services Bulletin issued on August 25 2021 TSB-M-21 1C 1I. In New York the deduction was worth 94 percent of AGI while the average across all states and the District of Columbia was 46 percent. It is useful to compare the distributional impact of SALT cap repeal to other tax policies or packages.

16 2020 New York legislation was submitted to impose an unincorporated business tax UBT on partnerships and limited liability companies that are treated as. New York State enacted a work-around for the 10000 SALT deduction limitation in its budget bill signed into law in the spring of 2021 see our prior Alert here. The state and local tax SALT deduction allows taxpayers of high-tax states to deduct local tax payments on their federal tax returns.

On a most superficial level it might seem obvious that the TCJA provision capping state and local tax SALT deductions at 10000 would have to represent a tax increase for many middle-class residents of high-taxed states like New York where property taxes on a downstate suburban house can approach or exceed the limit. The enactment of the cap on the SALT deduction reduces income available to New Yorkers. Residents of New York can take a credit against their personal income tax for any PTE-type tax paid to other states within certain parameters.

The bill passed on Thursday includes some budgetary gymnastics in order to avoid. The average size of those new york salt deductions was 2103802. 53 rows the impact of the salt deduction will change somewhat however as a result.

Yet while the newly adopted budget encourages high-income taxpayers to take advantage of. The tax plan signed by President Trump in 2017 called the Tax Cuts and Jobs Act instituted a cap on the SALT deduction. The limitation on the deductibility of state and local taxes SALT at 10000 was part of the Tax Cuts and Jobs Act back in 2017.

Republicans had slashed the SALT deduction to 10000 in their 2017 tax cut bill a move that some Democrats derided as a partisan revenge mission against high-tax blue states like New York New. New York nonresident owners need to consider the impact to their resident state filings eg ability to receive a credit for taxes paid under the PTE regime. House Democrats spending package raises the SALT deduction limit to 80000 through 2030.

Unlike most states New Yorks fiscal year begins early on April 1 so it was motivated to act quickly. This report examines the broader impacts of the increased tax burden on the New York economy. This report shows that the cap which is effectively a tax increase for New Yorkers is having a sustained negative effect on employment and output in New York State.

Expansion of medicare taxes for taxpayers with over 400000 of income in certain circumstances. Friday December 18 2020. The cap affects high tax states like New York.

Assuming this taxpayer also owns a home in New York property taxes will consume much of the 10000 federal cap so this SALT workaround will allow the taxpayer to deduct up to 10000 of state and local taxes paid in addition to a 12000 charitable contribution instead of being limited to a 10000 deduction for the total state and local taxes paid. Biden to include the elimination of the SALT cap as. 53 rows The SALT deduction also generally benefits states that have relatively large numbers of high-income taxpayers and high-tax environments.

For tax years beginning January 1 2021 and before January 1 2022 the election into the PTE taxcredit opportunity must be made on or before October 15 2021. Each 1 reduction in personal income reduced total economic output in the state by 117. The change may be significant for filers who itemize deductions in high-tax states and.

Many states have recently enacted SALT cap workarounds to protect. With the SALT limitation in place New Yorkers who already send 40 billion more in taxes to federal coffers than the state receives in return face the manifestly unfair risk of being taxed twice on. 10 2019 402 pm ET.

Starting with the 2018 tax year the maximum SALT deduction available was 10000. One obvious point of. The Tax Cuts and Jobs Act of 2017 TCJA set a limit on the amount of state and local taxes SALT that people can deduct from their federal taxes.

Lifting the SALT cap much more pro-rich than Trumps tax bill. Learn about New Yorks pass-through entity tax to help you work around it. On April 19 2021 New York Governor Andrew Cuomo signed into law legislation that creates a New York Pass-Through Entity Tax effective for tax years beginning on or after January 1 2021.

This consequential tax legislation available to electing pass-through entities provides a mechanism for New York State individual taxpayers to limit the impact of the. More businesses are taking advantage of a New York law that lets their employees avoid a federal cap on the amount of state and local taxes they can deduct from. The SALT cap limits a persons deduction to 10000 for tax years beginning after December 31 2017 and before January 1 2026.

The cap disproportionately affected those not subject to the alternative minimum tax amt which. While other states are considering workarounds to the Tax Cut and Jobs Acts TCJA 10000 annual limit on the federal deduction for state and local taxes SALT on individual income tax returns New York became the first state to pass actual legislation. If the 2017 SALT cap were eliminated New.

Options To Reduce The Revenue Loss From Adjusting The Salt Cap Itep

Options To Reduce The Revenue Loss From Adjusting The Salt Cap Itep

How Does The Deduction For State And Local Taxes Work Tax Policy Center

New York Enacts Pass Through Entity Tax Election As Salt Deduction Workaround Our Insights Plante Moran

The Salt Tax Deduction Is A Handout To The Rich It Should Be Eliminated Not Expanded

/cdn.vox-cdn.com/uploads/chorus_asset/file/9551427/distribution_repeal_SALT.png)

The State And Local Tax Deduction Explained Vox

How Does The Deduction For State And Local Taxes Work Tax Policy Center

What S The Deal With The State And Local Tax Deduction Publications National Taxpayers Union

How Does The Deduction For State And Local Taxes Work Tax Policy Center

Options To Reduce The Revenue Loss From Adjusting The Salt Cap Itep

For Most New York Income Tax Filers Salt Deduction Still Isn T Missed Empire Center For Public Policy

What Is The Salt Cap And Why Do Some Lawmakers Want To Repeal It

Congress And The Salt Deduction The Cpa Journal

Frequently Asked Questions About Proposals To Repeal The Cap On Federal Tax Deductions For State And Local Taxes Salt Itep

For Most New York Income Tax Filers Salt Deduction Still Isn T Missed Empire Center For Public Policy

:no_upscale()/cdn.vox-cdn.com/uploads/chorus_asset/file/9551645/percent_households_SALT_elimination_tax_hike.png)

The State And Local Tax Deduction Explained Vox

:no_upscale()/cdn.vox-cdn.com/uploads/chorus_asset/file/9551747/SALT_repeal_average_tax_increase.png)

The State And Local Tax Deduction Explained Vox

/cdn.vox-cdn.com/uploads/chorus_asset/file/22991459/1236366936.jpg)

What Proposed Salt Changes Could Mean For Your Next Tax Bill Vox